Expansion of Cloud Infrastructure

The expansion of cloud infrastructure is a significant driver of the Cloud Based Business Analytic Market. As cloud service providers enhance their offerings, organizations are increasingly migrating their analytics operations to the cloud. This transition allows for greater flexibility, scalability, and accessibility of data analytics tools. The proliferation of high-speed internet and advancements in cloud technology facilitate this shift, enabling businesses to harness the power of analytics without the constraints of traditional systems. As more organizations adopt cloud-based solutions, the Cloud Based Business Analytic Market is poised for substantial growth, with projections indicating a potential market size of USD 150 billion by 2027.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver in the Cloud Based Business Analytic Market. Organizations are increasingly seeking solutions that minimize operational costs while maximizing analytical capabilities. Cloud-based analytics platforms offer scalable solutions that reduce the need for extensive on-premises infrastructure, thereby lowering capital expenditures. This shift towards cost-effective solutions is particularly appealing to small and medium-sized enterprises, which may lack the resources for traditional analytics systems. As businesses continue to prioritize budget-friendly options, the Cloud Based Business Analytic Market is expected to witness sustained growth, with a projected increase in adoption rates among cost-conscious organizations.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Cloud Based Business Analytic Market. These technologies enable organizations to process vast amounts of data efficiently, uncovering patterns and trends that were previously difficult to identify. The incorporation of AI-driven analytics tools is expected to enhance predictive capabilities, allowing businesses to anticipate market shifts and customer needs. As a result, the market is projected to expand significantly, with estimates suggesting a growth rate of around 12% annually over the next five years. This technological evolution is likely to redefine how organizations approach analytics, making cloud-based solutions increasingly indispensable.

Growing Importance of Data Governance

Data governance has emerged as a pivotal concern within the Cloud Based Business Analytic Market. As organizations accumulate vast amounts of data, ensuring its accuracy, security, and compliance with regulations becomes paramount. The rise of data privacy laws and regulations necessitates robust governance frameworks to manage data effectively. Companies are increasingly investing in cloud-based analytics solutions that incorporate strong governance features, enabling them to maintain compliance while deriving insights from their data. This trend is likely to drive growth in the market, as organizations recognize the need for reliable governance mechanisms to support their analytics initiatives.

Rising Demand for Data-Driven Decision Making

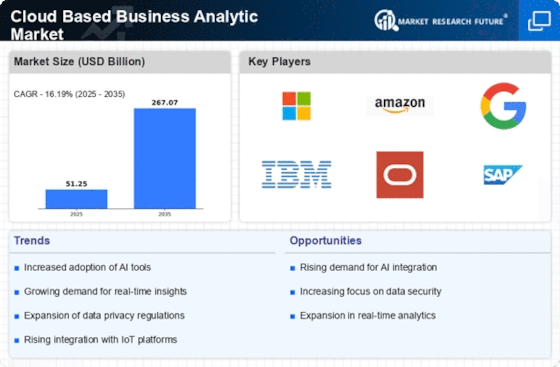

The Cloud Based Business Analytic Market experiences a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are leveraging analytics to gain insights into customer behavior, operational efficiency, and market trends. According to recent estimates, the market for business analytics is projected to reach USD 100 billion by 2026, reflecting a compound annual growth rate of approximately 10%. This trend indicates that businesses are prioritizing data analytics to enhance their competitive edge. As organizations strive to make informed decisions, the reliance on cloud-based solutions for analytics is likely to grow, further propelling the Cloud Based Business Analytic Market.